Note from the author: If you haven’t read Part 1, please go through it for a clear understanding of the plot.

⚠️ Disclaimer Before You Dive In:

- All the information and examples mentioned in this blog are purely fictional and for educational purposes only. The brand “I’m Paper,” its numbers, and scenarios are imagined to help you better understand the concepts of Unit Economics.

- To all the serious readers who are genuinely keen to learn, I highly recommend you to sit down with a pen and paper. This blog is packed with valuable insights, formulas, and real-world thinking.

If you’re here to grow, don’t just read it, but absorb it. Note it down. Trust me, these are the kind of concepts that separate a hustler from the rest.

Welcome back ladies and gentlemen, good to see you again!!

Imagine you’re running a tuition centre. It got super popular in your city. Your classes are full, and now students from other areas are requesting seats. All of this is happening because of the quality of your teaching.

Now tell me honestly, Will you hesitate to open new branches even after seeing such heavy demand?

Of course not.

Because higher demand = more revenue, a bigger brand, and new opportunities to grow.

So again, I’m asking you, what would you do?

You will expand.

And in the business world, this expansion is called scaling.

In Part 1, we saw how Vishwa built his notebook company “I’m Paper.” He started small, sourced products from different vendors, experimented, and learned about the size and behaviour of the notebook market. Along the way, you as the reader, learned the basic terms behind the economics of a business.

Now, “I’m Paper” is gaining popularity. Sales have increased. Demand has spiked. But his current manufacturing capacity is not enough to meet the market demand.

So, Vishwa has decided to scale the business.

But to scale, you need to tick a few boxes. Let’s take a look at what those are:

Product Market Fit:

- Are customers loving your product?

- Are you getting repeated sales?

- Can you see future in your product and business?

If your answer is YES for all these questions, then Bang On… You have figured out the right product for the market.

Distribution:

- Is your supply chain robust to handle the heavy sales after scaling?

- Do you have fixed, reliable suppliers that don’t give up during adversities?

- Have you stabilized the price, quality fluctuations?

- Do you have a team and backend systems, capable to handle heavy sales?

If your answer is YES for all these questions, then Good Job. You are on the right path.

Cashflow:

This is very important one. If you fail to figure it out at the start, you and the business will have a very tough time ahead.

- Is your business profitable with strong net margins?

- Did you secure any strong investment?

Read this carefully, if your answer is YES for any “one” of this, then kudos to you. You are ready to play the big game.

Unit Economics:

- Does your business have strong unit economics?

The journals of brand “I’m Paper” are getting sold like hotcakes in the market. They got good distribution to cater the scale. But Vishwa still doesn’t know whether his unit economics are strong enough to sustain it. From part 1, we understood: Gross Revenue, COGS, Gross Profit, Gross Margin, OPEX, Net Profit, Net Margin.

But that’s not the end, it’s just the beginning.

Now, let’s understand Unit Economics: Part 2 through the lens of the brand “I’m Paper.”

Here we go…

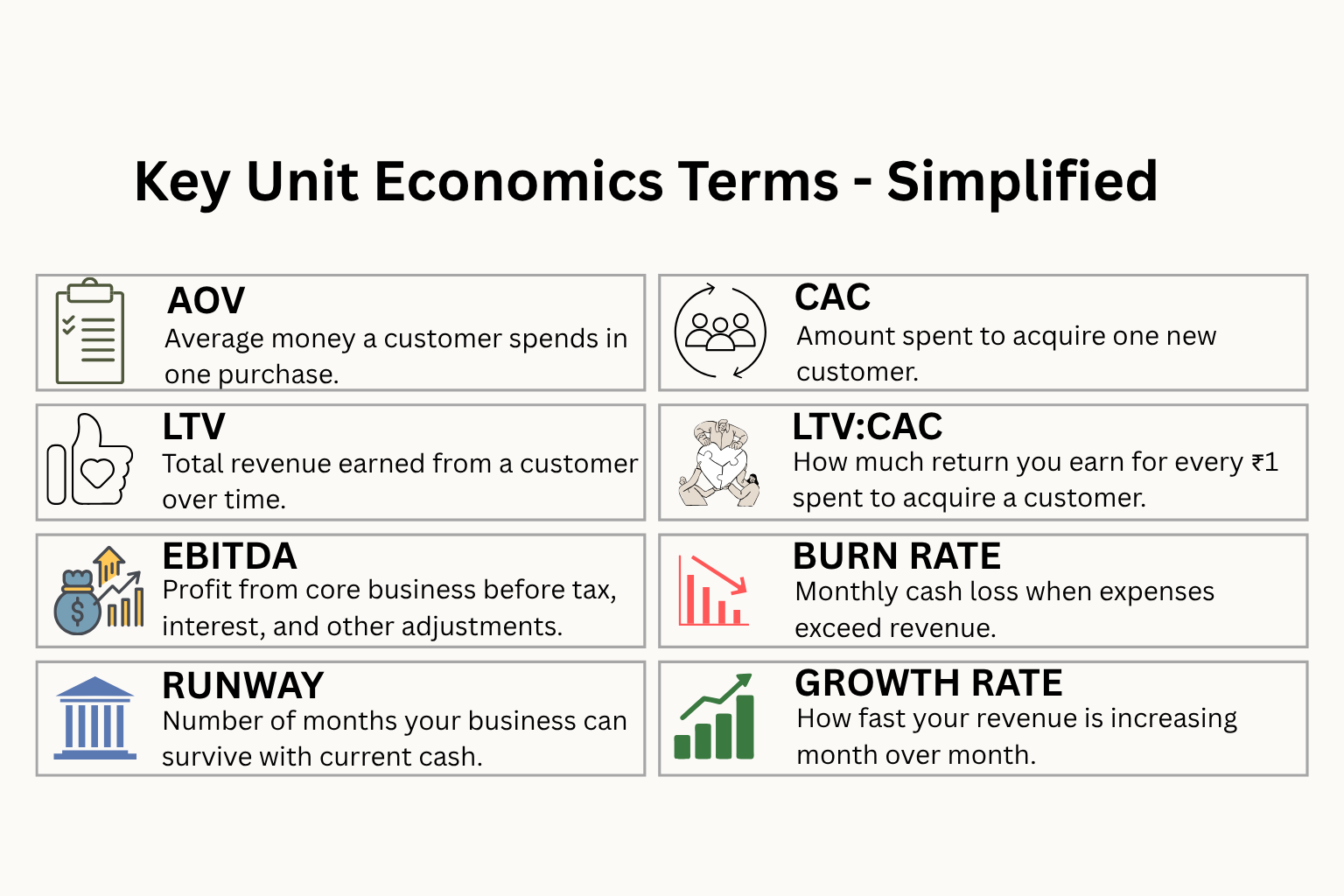

If you’re a serious reader, take a minute to go through this chart.

It shows the financial numbers of “I’m Paper” in Quarter 1 (Jan–Mar), the base from which all the unit economic terms are calculated.

Don’t skip it, this is where the story begins.

Average Order Value (AOV):

Average Order Value is the average amount of money a customer spends in a single order.

Imagine there are two shops, one is a local Kirana store and the other is a big supermarket.

You go to the Kirana store and buy something worth ₹50 and come back.

Next time, you go to the supermarket and spend ₹200.

So, Are you spending more money at the supermarket compared to the Kirana store?

Absolutely yes.

Is the AOV of the supermarket higher?

Yesss, because customers tend to spend more there.

AOV tells you how much money you make per sale. The higher it is, the faster you reach your revenue goals.

Simple logic: If your AOV is high, you have more room to spend on marketing.

Now let’s calculate AOV for “I’m Paper” (for Q1: Jan–Mar):

Formula: Total Revenue ÷ Total Orders

Total Revenue or Gross Revenue (Q1): ₹3,75,000

Total Orders: 1500

Calculation: ₹3,75,000 ÷ 1500 = ₹250

So the AOV of “I’m Paper” is ₹250. Coincidentally, each journal’s selling price is ₹250, meaning most customers buy just one journal per order.

Customer Acquisition Cost (CAC):

Every business needs marketing to reach its customers to promote products and ultimately drive sales.

Customer Acquisition Cost tells you how much you spend to acquire one new, unique customer.

If your CAC is high, you need to reduce it to improve your profit margins.

If your CAC exceeds your profit, your business is losing money and can go bankrupt if cash reserves are low.

Now, let’s calculate CAC for “I’m Paper”:

Formula: Marketing Cost ÷ Total New, Unique Customers

Marketing Cost: ₹75,000

New, Unique Customers Acquired: 600

Calculation: ₹75,000 ÷ 600 = ₹125

So, CAC = ₹125, which is half the selling price of one journal, that’s a good sign!

Lifetime Value (LTV):

LTV tells you how much money a customer will bring into your business over their entire relationship with your brand.

Let’s say you love pani puri and visit a stall once every month, spending ₹100 each time.

That’s ₹1200 a year. Your LTV, in this case, is ₹1200.

Of course, in real business, customers may not buy consistently, some months they might buy more, some less.

Knowing LTV helps you determine how much you can afford to spend on acquiring a customer.

For “I’m Paper”:

Formula: AOV × Purchase Frequency × Customer Lifetime

AOV: ₹250

Purchase Frequency: 3 orders/year

Customer Lifetime: 2 years

Calculation: ₹250 × 3 × 2 = ₹1500

So, each customer brings ₹1500 over 2 years to “I’m Paper.”

LTV:CAC Ratio:

This ratio tells you how much revenue you generate for every ₹1 spent acquiring a customer.

Formula: LTV ÷ CAC

LTV: ₹1500

CAC: ₹125

Calculation: ₹1500 ÷ ₹125 = 12

So, for every ₹1 spent, “I’m Paper” earns ₹12.

LTV:CAC Ratio = 12:1 ratio is exceptional!

🔼 < 1:1 = Business is losing money

🔼 1:1 to 2:1 = Breakeven, not ideal for scaling

🔼 3:1 to 4:1 = Healthy

🔼 > 5:1 = Excellent, ready to scale

EBITDA:

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization.

It shows the operating profit of your business before financial and accounting adjustments.

Have you ever heard investors ask, “What’s your EBITDA?” on Shark Tank?

It’s because they want to know how strong your core operations are, without the noise of taxes and other charges.

Is Net Profit the same as EBITDA? No.

Net Profit is the final profit after deducting interest, taxes, depreciation, and amortization.

EBITDA is your profit before these deductions, it’s a performance indicator of your core business.

Formula:

EBITDA = Net Profit + Interest + Taxes + Depreciation + Amortization

Given:

Net Profit = ₹90,000

Interest = ₹5,000

Taxes = ₹4,000

Depreciation = ₹8,000

Amortization = ₹3,000

Calculation:

₹90,000 + ₹5,000 + ₹4,000 + ₹8,000 + ₹3,000 = ₹1,10,000

So, with a gross revenue of ₹3,75,000, “I’m Paper” has an EBITDA of ₹1,10,000 and Net Profit of ₹90,000, it’s a solid performance!

Quick Definitions:

Depreciation: Decrease in value of physical assets like machines, laptops, etc., over time.

Example: Your car’s value reduces each year, it’s a depreciating asset.

Amortization: A fancy word used to break down the cost of intangible assets, like software licenses, patents, trademarks, domain names, hosting, over their entire useful period.

Example: You buy a ₹1,00,000 software license valid for 5 years, you record ₹20,000 as expense each year.

Burn Rate:

Burn Rate is the amount your business loses each month.

In January and February, “I’m Paper” is profitable with ₹1,25,000 and ₹1,00,000 in revenue respectively.

But in March, even though revenue is ₹1,50,000, expenses hit ₹1,80,000.

Formula: Monthly Expenses – Monthly Revenue

Calculation: ₹1,80,000 – ₹1,50,000 = ₹30,000

So the business burned ₹30,000 in March.

Runway:

Runway tells you how long your business can survive with the cash you currently have.

Formula: Cash in Bank ÷ Burn Rate

Cash in Bank: ₹9,00,000

Burn Rate: ₹30,000

Calculation: ₹9,00,000 ÷ ₹30,000 = 30 months

So, “I’m Paper” has a runway of 30 months, 2.5 years of operational breathing space.

That gives them the freedom to experiment and expand product lines.

Here are your 7 Unit Economic Terms.

Wait… before we move on, thank you for reading this far.

I truly appreciate your curiosity and willingness to learn. That puts you among the top 10% people who take the extra step to understand how things really work.

And because you’ve stayed till here, I’ve got something extra for you, a bonus term that investors love to hear:

Growth Rate (MoM – Month over Month):

Growth Rate tells you how fast your revenue is increasing month over month.

In simple words, Are you growing, slowing, or just stuck in one place?

Let’s calculate it for “I’m Paper”:

Formula: (Current Month Revenue – Last Month Revenue) ÷ Last Month Revenue × 100

- Current Month Revenue (March): ₹1,50,000

- Last Month Revenue (Feb): ₹1,00,000

Calculation:

(1,50,000 – 1,00,000) ÷ 1,00,000 × 100 = 50%

So, “I’m Paper” has a Growth Rate of 50%, which is massive.

That clearly shows the brand is reaching more people, converting better, and scaling fast.

Investors love momentum. That’s the kind of number that grabs attention in the room.

Conclusion:

As a founder, or future founder, it is your responsibility to understand Unit Economics.

CAs (Chartered Accountants) will usually calculate unit economics for your business, and yes, with them, you can relieve some work from your shoulders.

But as a founder, it is your absolute responsibility to understand and calculate the unit economics of your business, for better decision-making, better business understanding, and better investment opportunities.

Let the CA do their job. Ask them to calculate all the finances.

But simultaneously, I want you to do your part.

If you don’t understand your business inside out, who will?

Because,

You are not just there to control and hold the business,

You are there to lead.

thehustleweek.com is here to remind you every week that you’re not alone on this journey. Don’t waste another year stuck in imagination; start taking action today. Each week, theHustleWeek aims to unlock your potential by providing valuable insights that inspire and empower you to think differently.

As a community of hustlers, theHustleWeek aims to positively impact your life. If you found this article useful, please share it and leave your thoughts in the comments section. Your feedback encourages us to create more curated content. Feel free to explore our other blogs as well.