Introduction to IPOs

Do you love pizzas? Well, I do! I love Domino’s Pizza, and Jubilant Foods is the company that makes Domino’s Pizza. What if I owned a part of Jubilant Foods? Mmm, I could profit from the company’s growth.

But let’s say Jubilant Foods is a private company. Do you get a chance to buy shares in it? NO. As a private company, not everyone can invest; only promoters (owners of the company), friends and family, angel investors, venture capitalists, and a few others can invest. Now what is IPO?

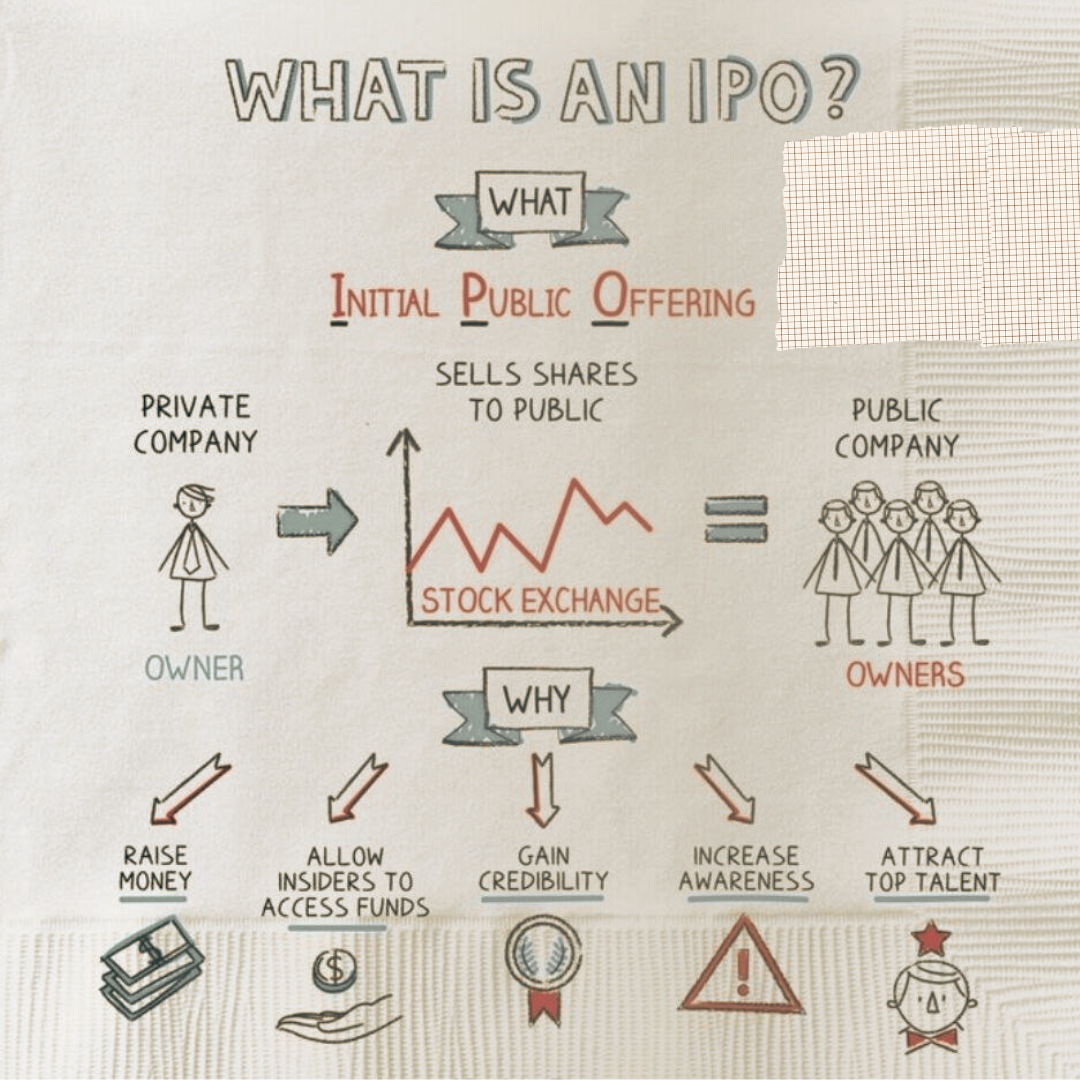

An IPO is nothing but an “Initial Public Offering.” As the name suggests, a company will allow the public to buy shares of its firm to raise capital. Once this happens, it becomes a publicly listed company, and it can be listed on the BSE (Bombay Stock Exchange), NSE (National Stock Exchange), or both. Every day, its stock price will fluctuate based on the company’s growth. Thus, it is valued according to the price of its stock.

Why Companies Go Public

Every company has its own vision and targets, and a company goes public for any of the following reasons:

- Expansion: If a company wants to expand its operations, it can go public to raise a certain amount of capital by diluting some shares in the company. For example, if “XYZ Solutions” wants to raise $1 billion to enhance services, hire more people, and develop infrastructure, they file for an IPO. Once the process is completed, the company will be listed, and public investors can buy shares, with that money going directly to the company.

- To Pay Off Debts: In the early stages, a company may take loans to grow. However, this debt can limit growth. To clear this debt, the company can go public. For instance, if “XYZ Solutions” makes a profit of 30 rupees but has a loan interest of 40 rupees, they will incur a loss even with a good profit margin. So, they opt for an IPO to eliminate the debt.

- Exit for Investors: Companies often have early investors like angel investors or venture capitalists who wait for the company to go public before selling their shares and booking profits. If “XYZ Solutions” wants to provide an exit for their investors, they can go public.

Types of IPOs

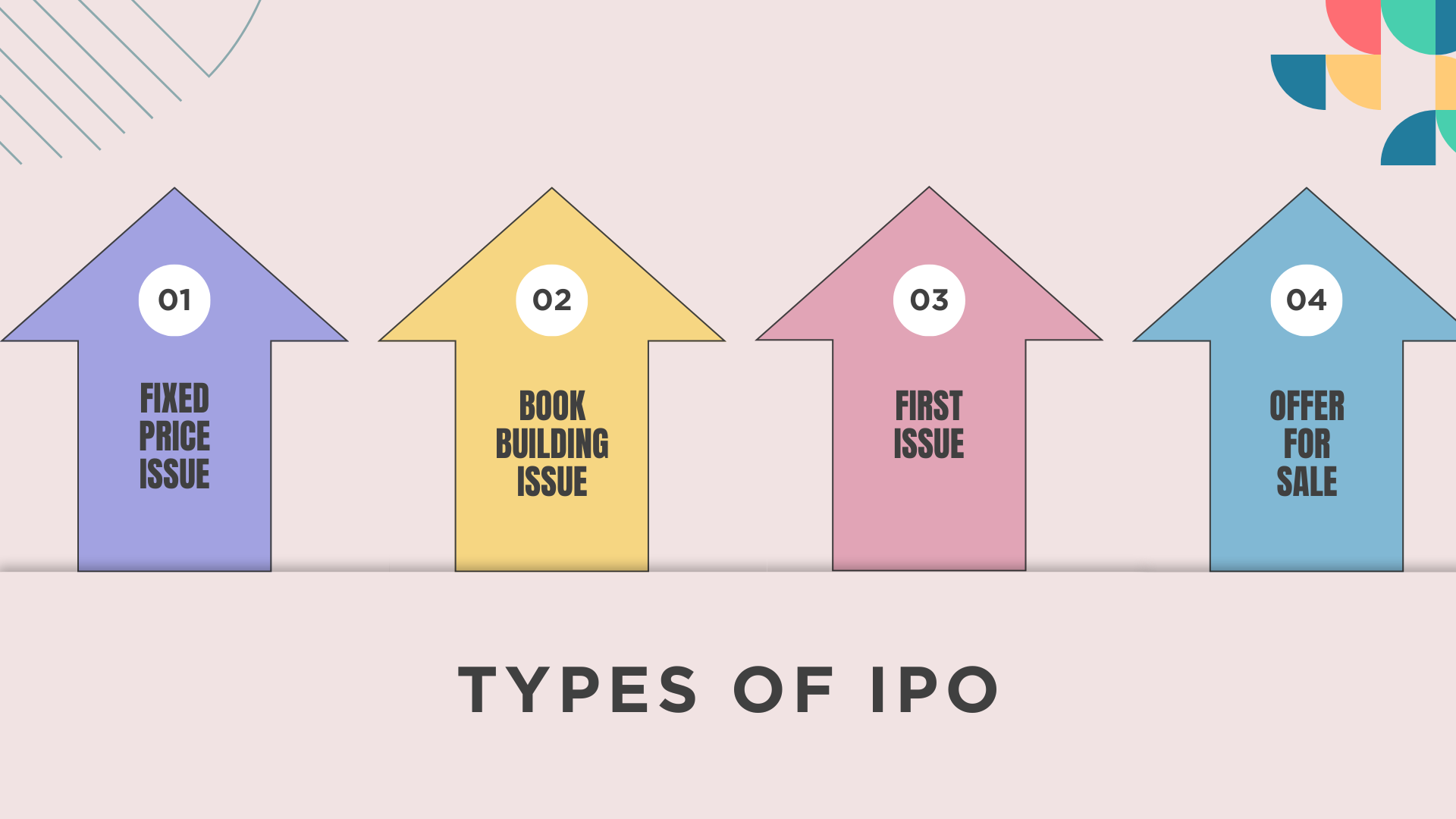

Now that you know what an IPO is and why a company goes public, let’s explore the types of IPOs and how the share price is decided.

- Fixed Price Issue: Suppose “XYZ Solutions” wants to sell 1,000 shares at an individual price of 100 rupees, neither more nor less. When the fixed price option is chosen, the share price cannot be adjusted based on market sentiments. So, if the market is eager to buy at a higher price, it remains at 100 rupees. Similarly, if the market shows little interest, the price cannot drop. This method is straightforward but risky, as it doesn’t account for market dynamics, and the expected capital might not be raised.

- Book Building Issue: In this case, “XYZ Solutions” sets a price range of 90 to 110 rupees. Investors can bid for the price they are willing to pay. If investors are ready to buy at more than 100 rupees, the price adjusts accordingly, and if they bid less, the price is adjusted downwards. This method increases the chances of selling shares as it is based on demand.

- Fresh Issue: If a company has 100 shares and wants to raise more money by issuing new shares, it is called a fresh issue. The company creates brand new shares for the public to buy, and the funds raised directly benefit the company. If “XYZ Solutions” has 100 shares owned entirely by the promoter and creates 50 new shares, the total becomes 150 shares. The promoter then owns only 66.67% of the company, while the remaining shares are available to the public.

- Offer for Sale: If existing investors wish to cash out some of their investment, they will sell a portion of their ownership to the public. In this case, when shares are bought, the money goes to the existing investors, not the company.

IPO Regulations in India

There are specific rules and procedures a company must follow to get listed. SEBI (Securities and Exchange Board of India) ensures that investors’ interests are protected and that the IPO process is fair and transparent. It guarantees that all information about the company is accessible to the public without bias.

One key guideline from SEBI is the ICDR Regulations (Issue of Capital and Disclosure Requirements), which ensure that companies meet certain standards before going public. Only if these standards are met can the process move forward.

After this, the company must submit the DRHP (Draft Red Herring Prospectus) to SEBI. This is a key document providing an overview of the company, its future plans, business model, and finances.

Once SEBI is satisfied with the DRHP, the company can file the RHP (Red Herring Prospectus), the final version issued to the public after SEBI’s approval.

Process of Launching an IPO

- Review Underwriter Proposals: When the company decides to go public, it selects an underwriter based on the value they bring to the table. Factors include services, fixed price potential, and the amount of money that can be raised.

- Due Diligence: Due diligence involves evaluating all the company’s legal and financial documents to ensure they are trustworthy. It acts as a safeguard against potential fraud, misrepresentation, or unforeseen liabilities.

- Underwriter: An underwriter analyzes the company’s financials, market position, and possible share price to determine if it is ready for an IPO. There are three types of underwriters.

- Setting Up an IPO Team: The company will assemble a team of experienced individuals, including accountants, lawyers, and underwriters, to assist in going public.

- Marketing and Roadshows: The IPO team promotes the IPO to institutional investors and retail investors to generate hype in the market.

Types of Investors

- Retail Investors: These are individual public investors with an investment capacity of 2 lakhs and below. Typically, only 10% to 35% of shares are allotted to retail investors, meaning they cannot purchase every available share.

- HNI (High Net Worth Individuals): These investors possess significant wealth. A total of 15% of shares are allotted to them.

- QIBs (Qualified Institutional Buyers): QIBs include mutual funds, insurance companies, etc. They are allocated 65% of shares.

Key Considerations for Investors

- Company Fundamentals: Analyze the company’s business model, financials, competitive edge, and growth prospects.

- Valuation: Determine if the IPO is priced fairly compared to peers.

- Market Sentiment: Consider overall market conditions; bullish markets may lead to oversubscription, while bearish markets may cause underperformance.

- Risks: IPOs carry risks, especially in volatile market conditions. It’s crucial to assess risk factors mentioned in the prospectus.

This is all about IPOs in India, and we hope this article has added value to you. Financial literacy is essential, and theHustleWeek will continue to provide content on startups, motivation, and self-growth every week. Make sure to follow this page regularly for more insightful content.

Disclaimer

Investing in securities markets is subject to market risks. Please read all related documents carefully before investing.

FAQs

Can we buy a single share in an IPO?

No, we typically cannot buy a single share in an IPO. Shares are sold in “lots,” which consist of a certain number of shares. For example, if a lot has 150 shares at an individual price of 100 rupees, you need to spend 15,000 rupees to buy them. However, after the opening day, you can buy shares individually.

What is Firm Commitment by underwriters?

In a firm commitment, the underwriters guarantee the company a certain amount of money by purchasing a specific number of shares. If that mark is not met, they will buy the unsold shares, bearing the risk.

What is FPO?

A Follow-On Public Offer (FPO) is when a company that is already listed issues new shares to raise additional funds.